In 2012, President Obama signed the Jumpstart Our Business Startups Act (JOBS Act). Title III (Regulation Crowdfunding or Reg CF) allowed smaller companies to crowdfund investment online from many smaller investors. Reg CF allowed everyone into the world of private-company investment—companies not registered or trading shares on national exchanges. Previously, the Securities and Exchange Commission (SEC) allowed only “accredited investors,” those meeting certain wealth or income thresholds, to invest in private companies. The SEC finalized the Reg CF rules in May 2016.

Reg CF Basics:

• Companies (issuers) can raise up to $1.07m over a 12-month period selling different types of securities that represent ownership, future ownership, or debt obligations.

• Issuers set minimum and maximum ranges for the overall raise and individual investment minimums. Further SEC regulations limit maximum individual investment through an income/net-worth formula.

• Issuers must file CPA-reviewed financial statements and a legal document (Form C) with the SEC, which contains certain disclosures about the company. They also must file at least one year-end report.

• Issuers sell their securities over a FINRA-approved intermediary (portal). There are currently around 55 portals. The biggest ones have lists that contain hundreds of thousands of potential investors, along with media and industry insiders.

• Securities are restricted, meaning investors must generally hold them for one year, with exceptions.

Equity Crowdfunding so far

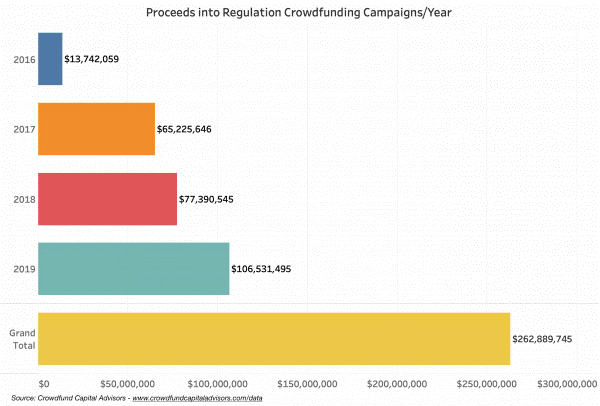

In the past four years equity crowdfunding has steadily grown. Crowdfund Capital Advisors (CCA), which curates equity crowdfunding data reports Reg CF raises have pumped almost $1 billion into local economies. And Reg CF year-to-year growth currently stands at a healthy 37%.

Further, robust growth has continued during the current pandemic, CCA reports:

• July was the highest month of investor commitments at $23.2 million. The next closest month was October 2019 with $18.5 million.

• June and May of this year were the 3rd and 4th highest months of commitments.

• The first quarter of this fiscal year saw more commitments than the entire first year of Regulation Crowdfunding.

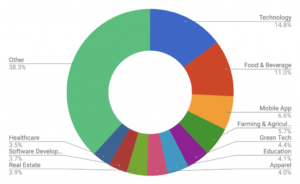

Types of Companies using Reg CF

Issuers come from a variety of industries including everything from technology-related fields to restaurants to apparel. Companies that have a strong consumer focus or an existing customer/client base to provide initial investment are particularly well suited to this capital-raising form.

Source: Start Engine

What Equity Crowdfunding can do for your business

Besides capital to help your business grow, Reg CF provides other benefits unique to this model.

• Broaden your investor base: Unlike other funding models, Reg CF can diversify your investor base from both a financial and geographical standpoint. Portals can accept investors from anywhere in the US, giving your business a potential foothold in all 50 states.

• Turn your customers into marketers: Reg CF allows your customers to become financially invested in your business and see their investment grow as your business grows. This provides a free marketing campaign for your business with every new investor.

• Incentivize your investors: Reg CF allows you to provide perks as part of the investment. Depending on the product this could include the product itself, ‘founder’ status on your website, access to events, or anything else that may induce an investment.

• Prove value to institutional investors: A successful Reg CF raise can show larger, institutional investors your business is ready for the big money. Many larger investors are now requiring “social proof” of a company’s business model. Your business can show larger investors value and momentum and provide your business “bridge money” while larger investors evaluate your model.

Reg CF Future Fixes

In March, the Securities and Exchange Commission proposed several changes to Reg CF that will enhance its viability for entrepreneurs. These changes include raising the 12-month aggregate offer limit to $5 million, allowing issuers to gauge investor interest in a potential raise before committing (testing the waters), simplified individual investor limits, and allowing Special Purpose Vehicles to reduce capitalization-table issues. The SEC should act of these proposals sometime this year or next.

Check out other posts on Crowdfunding.