In the last few weeks, fast-growing businesses careened from maximizing growth on the crest of a long bull run, to scrambling for survival. No company is immune. Even the strongest and best-financed companies are taking uncommon measures to extend their cash runway.

This article shares 4 ways your law firm can help extend your company’s cash runway.

The insights we share here percolate from our daily work advising investor-backed private companies. Each company is unique. But if you’re reading this article, you can probably relate to NEXT.io. NEXT.io is an imaginary company. A fictionalized composite of the in-real-life clients who we advise as a law firm here at NEXT.

NEXT.io raised a Series A financing in 2018, and was planning to raise a Series B round in early 2020. The team posted above-average gross margin, CAC and retention for venture-funded companies in their industry and were feeling confident. But with the covid winter looming, the team is seeking ways to extend their cash runway.

Does this sound like you?

How exactly do I calculate cash runway? And how much is enough?

“Cash runway” measures how long your company’s money will last at your current cash burn rate. If you have $500,000 cash and $15,000 current net monthly burn rate, your cash runway is $600k / $30k = 20 months. A 20-month runway is healthy for most startups.

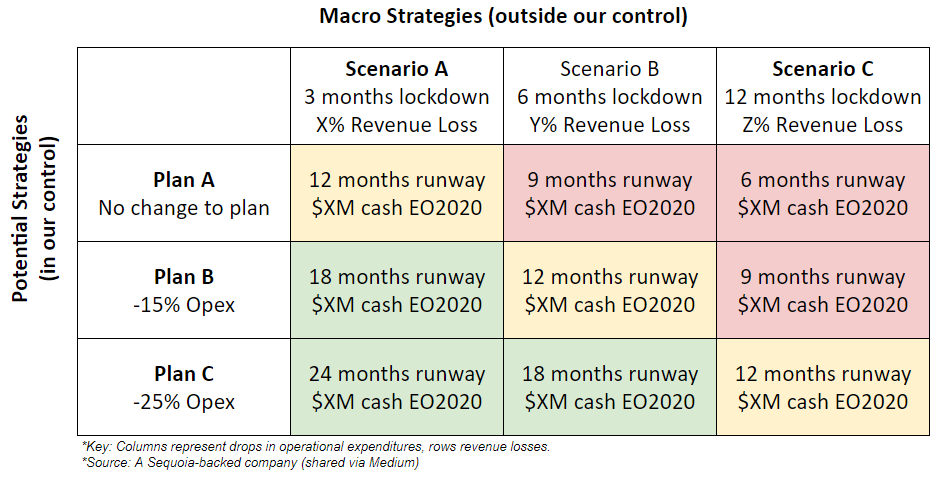

But you can’t calculate burn rate and runway without making assumptions about future revenue and expenses. Consider this runaway forecast matrix from an anonymous Sequoia Capital portfolio company. This table doesn’t tell you how much cash your company needs, it provides a framework to expose assumptions in forecasting your company’s cash runway.

If your company has sufficient runway to weather the coming year or so, congratulations. Now is a great time to focus on product and relationships with your community.

Everyone else needs to extend their cash runway.

How can my law firm help extend my company’s cash runway?

Here are 4 ways your law firm can help extend your company’s cash runway for 2020.

1. Apply for up to $10 million in forgivable federal loans.

You know by now the federal government made $350 billion in emergency paycheck support available for small businesses (up to 2.5x payroll or $10 million per company). But you’ve probably heard mixed messages about whether investor-backed companies should apply. Your law firm should be able to answer this question fairly easily by reviewing your last-round financing documents. If an investor has a specific control right rendering you ineligible, your law firm should be able to recommend a narrow and pragmatic amendment to the control provision that frees you up to apply for loans. This can be done with only a few hours’ work by an experienced venture capital lawyer and their federal loan colleague (this will be a different person in their firm). Read our longer post here.

2. Reduce your payroll expense without losing critical team members

You’re probably familiar with how layoffs work, but did you know there are at least 9 other ways you can reduce payroll expense, short of laying off large portions of your team? A good law firm can help you calculate the financial impact of layoffs compared to these other legal strategies. We will explore these options at length in our next post so stay tuned.

3. Negotiate equity financing on favorable terms

Venture capital investors raised over $46 billion dollars in new funds in 2019 alone and they have record amounts of cash to deploy. But valuations are dropping 30-40%. Even strong companies may need to accept a flat or lower valuation than their last financing round. It’s been over a decade since the startup industry saw mass down-rounds.

If your law firm is experienced in down-rounds, you can negotiate terms that strongly incentivize existing investors to contribute their pro rata or more, on a valuation that won’t scare off future recruits. The trick is balancing the equity impact on each stakeholder group: Investors, Management and Employees.

Your firm should be able to build a flat- or down-round financing model from your existing cap table, and walk you through several of the more common down-round financing structures, to see which approach best balances your specific stakeholder groups. This modeling exercise should take no more than a few hours for an experienced venture capital law firm.

4. Recover business losses from insurance.

Many of our startup and emerging growth clients are expecting significant cash runway impairment due to business losses stemming from facility closures and supply chain disruptions. If this is you, you may be able to recover from your insurance policies. We will write more about insurance recovery soon. Meanwhile please send us your questions or request a consultation with a senior insurance attorney on the NEXT team at [email protected].

Can NEXT help me extend my cash runway?

Yes! NEXT is a new model of legal service for emerging growth companies. NEXT has developed 75+ fixed-price legal service packages enabling growing companies to receive direct and hands-on legal advice from senior attorneys. We operate on a technology platform integrating best-of-breed tools across legal verticals for a collaborative, communicative and efficient client experience.

Learn more about NEXT’s Crisis Mitigation Legal Service Packages in response to COVID-19.

Send us your Startup Survival questions and sign up for our Startup Survival newsletter by emailing us at [email protected].