By: Liron Sharon Principal at YMS Value

I am often asked by entrepreneurs and business owners why the equity value used, or implied, in a 409A (or an ASC 718, stock-based compensation for financial reporting purposes) valuation is not necessarily an indication of the value of the equity.

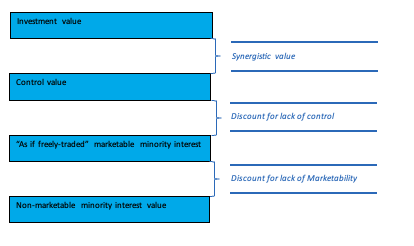

Here is a short explanation, using the levels of value chart below:

Investment value is the value for a specific buyer that can benefit from unique synergies with the acquired business.

Fair market value (or fair value) of a company is the value from the perspective of a market participant on a controlling basis (excludes any buyer specific synergies).

Since the subject of 409A and ASC 718 valuations is a minority interest in the company (usually one share of common stock) the valuation is done on a minority basis. Business appraisers often use valuation methods that are applied directly to a non-controlling interest, taking into account the economic benefits and risks inherent in owning a non-controlling interest, to derive the “as freely traded” marketable value of the minority interest (the third level), and then apply a discount for lack of marketability to account for liquidity issues associated with minority interest in a privately held entity (the forth level). Therefore, the analysis cannot be used as an indication of the value of the company.

In need of a 409A valuation? YMS Value is a business valuations and advisory firm providing a broad range of business valuations and advisory services.

This article was originally written for YMS Value and not NEXT powered by Shulman Rogers.