The numbers are in! After a brief respite, equity crowdfunding (Reg CF) is back to setting records. This is good news not only for elite zip codes where startup capital overflows, but for geographic and demographic cohorts usually starved of seed money.

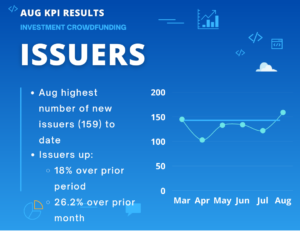

According to Crowdfund Capital Advisors (CCA), which curates Reg CF data, August saw 159 startups file equity crowdfunding paperwork. This tops the previous record of 153 in October 2021. Average investment is also near peak thresholds at $1,873. Valuations are also rising with four companies topping $100 million: Boxabl, Groundfloor, Koning, and Global Composite Piping Solutions.

For nontraditional founders and those outside Silicon Valley this means more opportunities to get the capital needed to turn ideas into revenue. As reported, in the past two years Black founders received 1.2% of venture capital funding and women just 2.3%. But those same cohorts were 40% of crowdfunded startups that raised over $1 million.

For nontraditional founders and those outside Silicon Valley this means more opportunities to get the capital needed to turn ideas into revenue. As reported, in the past two years Black founders received 1.2% of venture capital funding and women just 2.3%. But those same cohorts were 40% of crowdfunded startups that raised over $1 million.

Similarly, CCA found 92.4% of all Reg CF offerings took place outside known venture-capital meccas.

B-Corps, which incorporate social missions and base business decisions on a range of community stakeholders also benefit from Reg CF. Shulman Rogers client Neighborhood Sun is currently raising its second round on the WeFunder portal (itself a B-Corp).

Neighborhood Sun’s first raise topped $1M and its second is currently over $750k.

On Wednesday, September 12, Shulman Rogers partner Larry Bard will lead a panel at DC Startup week titled, How Equity Crowdfunding Moves Startup Capital Beyond Silicon Valley. Other panelists include founder Mariam Nusrat, whose company GRID recently completed a successful Reg CF round, Maria Pope of Reg CF portal Republic, and Reg CF lawyer Paul Jossey.

Register for free to DC Startup Week in person or online here.

Despite the amazing success and benefits of crowdfunding for startups, founders should take precautions before plunging in. Reg CF involves selling securities, which is a highly regulated area of federal law.

Founders should hire experienced counsel to guide them through the process. The original SEC Regulation Crowdfunding release is almost 700 pages and the commission has added guidance and interpretations several times. Moreover, the SEC Enforcement Division is ramping up scrutiny on Regulation Crowdfunding transactions.

Shulman Rogers has a package tailor-made to take the worry out of Reg CF capital raises. This includes: (1) fixed-price offers, (2) advice and preparation of legal documents, including financial instruments; (3) reviewing risks and maintaining SEC compliance; (4) personal introductions to major portals; and (5) on-call for any raise-related question for raise duration.

Contact NEXT powered by Shulman Rogers for a free consultation to see if Reg CF crowdfunding is right for your startup.

Source for photo: Crowdfund Capital Advisors