Equity crowdfunding is booming during the pandemic as evermore business functions migrate online. While other capital-raising methods struggle, entrepreneurs and investors alike are realizing the advantages of internet-based raises.

As the CEO of SeedInvest, one of the biggest equity crowdfunding portals, explained earlier this year:

Unlike venture capital firms, online fundraising platforms are perfectly situated to help startups in the current, post-COVID-19 world we are in. Online fundraising platforms are not dependent on capital from a handful of pensions and endowments, but rather a large, diverse network of investors. Additionally, while the traditional venture capital investment process is highly dependent on in-person meetings (which is next to impossible in the current environment), the online fundraising and investing process is inherently digitally native.

The numbers support this thesis. SeedInvest’s volume and number of investments in the first half of 2020 exceeded all of 2019. April was its best month ever. Wefunder, another huge portal, reported its three biggest months as March, April, and May of this year.

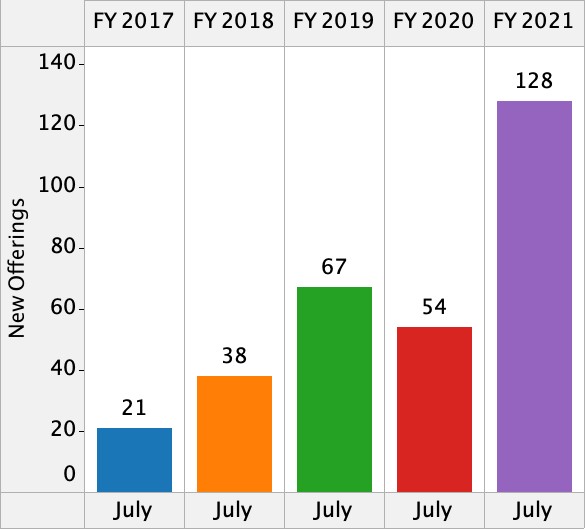

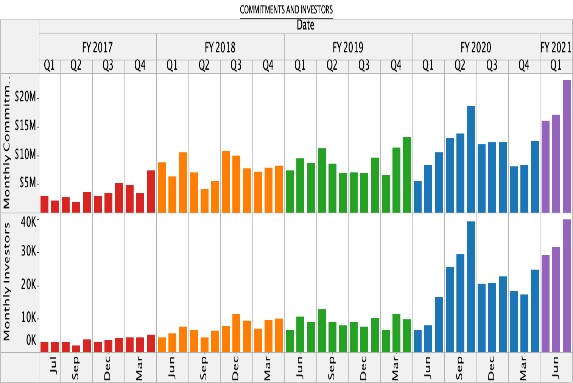

Now Crowdfund Capital Advisors, which curates equity crowdfunding data reports:

- July was the highest month of investor commitments at $23.2 million. The next closest month was October 2019 with $18.5 million.

- June and May of this year were the 3rd and 4th highest months of commitments.

- The first quarter of this fiscal year saw more commitments than the entire first year of Regulation Crowdfunding.

Source: Capital Crowdfund Advisors

Proposed SEC rule changes could further boost equity crowdfunding

Equity crowdfunding will likely keep booming even once normalcy returns. In March, the Securities and Exchange Commission proposed several changes to Regulation Crowdfunding—the law governing equity crowdfunding—that will enhance its viability. While the proposed measures fall short of the best possible Commission fixes, if enacted they will nonetheless improve the equity-crowdfunding landscape. These changes include raising the 12-month aggregate offer limit to $5 million, allowing issuers to gauge interest in a potential raise before committing (testing the waters), simplified individual investor limits, and allowing Special Purpose Vehicles to reduce capitalization-table issues. The SEC should act on these proposals sometime this year or next.

For now, as many people spend time home-ridden, some are seeking investment opportunities. Equity crowdfunding suits this environment. With a few clicks, potential investors can explore hundreds of portal-based opportunities, view financial and legal documents, and even query founders. After investing they can monitor raise progress in real time and instantly promote it to their networks. These unique features portend a democratized capital-raising future in its infancy. The equity crowdfunding ride is only just beginning.