In less than a decade, equity crowdfunding (Reg CF) has grown from curiosity to major force in equalizing access to startup capital. Now early or mid-stage companies seeking investment can use the power of the internet and their existing networks to raise capital and, as important, awareness. And it’s only the start!

Originally part of the JOBS Act of 2012, Reg CF went live in 2016 after resistance from both regulators and investors. Allowing everyday people to invest in pre-IPO companies was new and some predicted widespread fraud and lawsuits. That’s not how it turned out.

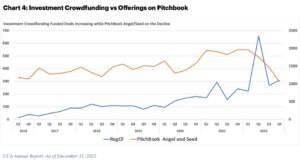

According to Crowdfund Capital Advisors (CCA), which curates equity crowdfunding data, 2022 marked the first time Reg CF surpassed angel and seed offerings on Pitchbook. Further, Reg CF issuers have pumped more than $4 billion into the economy and are directly responsible for at least 226,000 jobs. Finally, in aggregate, Reg CF issuers hold over $54 billion in total value.

Startup founders have noticed.

Now entrepreneurs who do not fit the conventional profile either through demographics or geography can shun traditional funders. CCA states, “women and minority entrepreneurs (that routinely struggle to access capital) have had greater success within Investment Crowdfunding and are raising up to 50% of the capital.”

Further, those outside the traditional entrepreneurial hubs of San Francisco, New York, and Boston are finally accessing the capital they need as Reg CF spreads investment more evenly throughout the country.

Reg CF is truly equalizing access to capital.

In 2021, the Securities and Exchange Commission recognized this success by raising the offer limit from $1.07 million to $5 million. In 2022, it adjusted the limit for issuers forgoing an audit from $1.07 million to $1.235 million.

As awareness grows and success stories multiply, Reg CF will only grow stronger both in absolute terms and compared to traditional capital strategies.

Here are some unique advantages of raising capital through equity crowdfunding:

- Broaden your investor base: Unlike other funding models, Reg CF can diversify your investor base from both a financial and geographical standpoint. Portals can accept investors from anywhere in the US, giving your business a potential foothold in all 50 states.

- Turn your customers into marketers: Reg CF allows your customers to become financially invested in your business and see their investment grow as your business grows. This provides a free marketing campaign for your business with every new investor.

- Incentivize your investors: Reg CF allows you to provide perks as part of the investment. Depending on the product this could include the product itself, ‘founder’ status on your website, access to events, or anything else that may induce an investment.

- Prove value to institutional investors: A successful Reg CF raise can show larger, institutional investors your business is ready for the big money. Many larger investors are now requiring “social proof” of a company’s business model. Your business can show larger investors value and momentum and provide your business “bridge money” while larger investors evaluate your model.

NEXT powered by Shulman Rogers can help with crowdfunding for startups with a fixed-fee Reg CF Package that includes; advice and preparation of legal documents, including financial instruments; reviewing risks and maintaining SEC compliance; personal introductions to major portals; and assistance for any raise-related questions.

To inquire about NEXT’s equity crowdfunding package please email [email protected].

Further Reading:

Eight reasons founders should retain a lawyer before engaging a portal when crowdfunding: https://next.law/you-want-to-crowdfund-8-reasons-lawyer-before-platform/

How equity crowdfunding moves startup capital beyond Silicon Valley: https://next.law/how-equity-crowdfunding-moves-startup-capital-beyond-silicon-valley/